|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

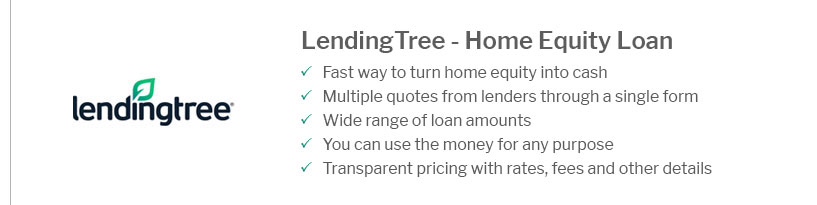

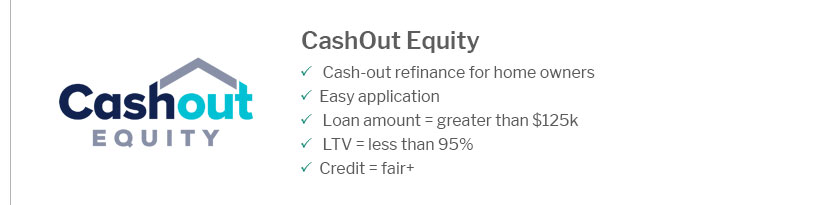

The Best Company to Refinance a Home: Key Benefits and Use CasesRefinancing your home can be a strategic move to reduce monthly payments, lower interest rates, or access equity. Choosing the best company to refinance a home is crucial for maximizing these benefits. Why Refinance Your Home?Refinancing can offer a multitude of advantages, depending on your financial goals and current market conditions. Lower Interest RatesOne of the primary reasons homeowners refinance is to take advantage of lower interest rates. This can lead to significant savings over the life of the loan. Reduce Monthly PaymentsBy refinancing, you may extend the loan term, which can decrease your monthly mortgage payments, providing more financial flexibility. Access Home EquityA cash-out refinance allows you to tap into your home's equity for major expenses like home improvements or debt consolidation. Key Considerations When Choosing a CompanyWhen selecting a refinance company, consider the following factors to ensure a smooth and beneficial process.

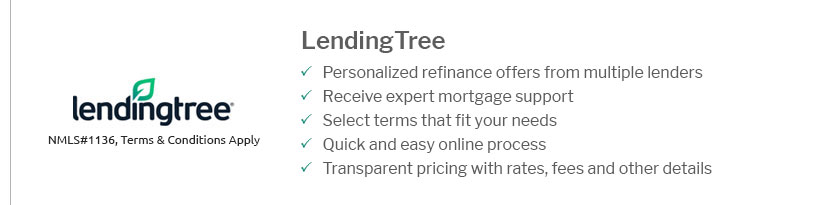

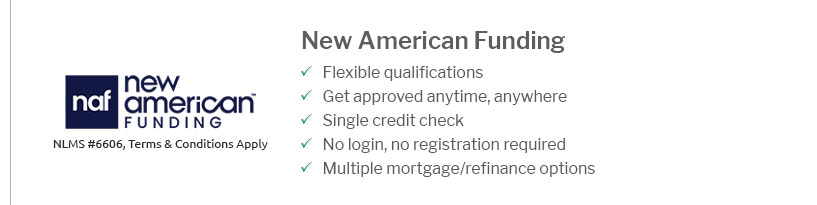

Top Companies for RefinancingWhile many lenders offer refinancing options, certain companies stand out for their comprehensive services and competitive rates.

For those with a credit score around 680, exploring specific refinance rates for 680 credit score might be beneficial to find the most suitable rates. Understanding the Refinance Settlement ProcessIt's important to understand the refinance settlement process to ensure a successful transition. The settlement process involves several key steps, including application, appraisal, underwriting, and closing. Each step requires careful attention to detail and communication with your lender. To gain a deeper insight into the steps involved, visit the refinance settlement process guide for comprehensive information. Frequently Asked QuestionsWhat is refinancing?Refinancing involves replacing your existing mortgage with a new one, usually to secure a lower interest rate or alter the loan term. How do I qualify for refinancing?Qualification typically depends on your credit score, income, and the amount of equity in your home. Lenders assess these factors to determine eligibility. Are there any drawbacks to refinancing?Potential drawbacks include closing costs, extending the loan term, and the risk of resetting the amortization schedule, which may increase total interest paid over time. https://www.navyfederal.org/loans-cards/mortgage/refinancing.html

Refinance Your Mortgage and Save. Depending on the terms of your current loan and how long you plan to stay in your home, refinancing could be the best ... https://www.ruoff.com/refinance

Ruoff fought tooth and nail to get me refinanced, kept me informed at all times, and got me the best interest rate possible. I highly suggest this company to ... https://www.nerdwallet.com/best/mortgages/refinance-lenders

Why We Like ItAs a large national bank, Citi offers solid customer support, a highly rated mobile app and discounts for existing banking ...

|

|---|